Chartered Financial Analyst

CFA

About the Program

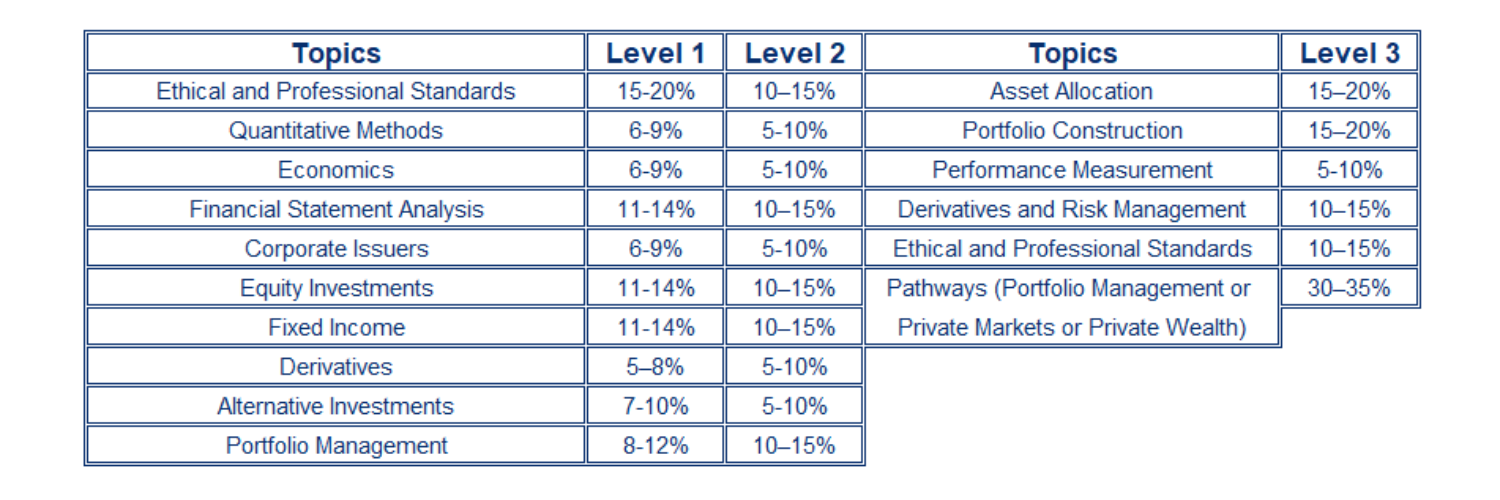

The Chartered Financial Analyst (CFA) Program is one of the most respected and globally recognized qualifications in the investment and finance industry. This course is designed to prepare participants for the CFA exams by covering core topics such as ethics, quantitative methods, economics, financial reporting, corporate finance, equity, fixed income, derivatives, alternative investments, and portfolio management.

Through a structured learning approach and practical problem-solving, participants will gain the knowledge and analytical skills needed to succeed in the CFA journey and advance their careers in investment banking, asset management, equity research, and financial analysis.

Why become a CFA Charterholder?

Mark of distinction

Show employers you have the knowledge and commitment to thrive in today’s complex and continually evolving investment industry.

Career opportunities

Open up new pathways into a wide range of investment decision-making careers, including asset and wealth management, commercial banking, and consulting.

Global gateway

Leverage the global recognition of the CFA Charter to pursue investment management roles anywhere in the world.

Stay ahead

Equip yourself with the skills to thrive in the evolving finance industry with a Chartered Financial Analyst credential.

Insights from experts

Learn key real-world skills in investment analysis from the leaders in investment education.

Enhanced professional profile

Earn an easily shareable digital badge to display your achievement in your online networks.

Course Content

Who is the CFA Program for?

– University students looking to launch a career in finance, corporate banking or investment management.

– Existing industry professionals wanting to establish or enhance their credentials.

– Professionals from other industries who want to change the focus of their careers.

Careers sectors For CFA holders

Private wealth

management

Risk analysis & risk

management

How long is the CFA exam

The CFA Level I exam lasts 4.5h, and consists of two content sessions that are 135 minutes each.

The CFA Level II and Level III exams also take 4.5h, and the time allotted for the two content sessions is 132 minutes each.

In all CFA exam levels, there will also be time allocated to a tutorial of the exam software, a break, and a survey at the end.

CFA exam dates & fees

CFA Program exams are administered four times a year, at over 400 testing centers around the world in most major cities.

You’re allowed to take the CFA exam a maximum of twice each calendar year but not in consecutive windows or windows

that are six months or less apart.

Use the interactive tool below to see upcoming CFA exam dates by level, as well as the latest CFA exam fees.

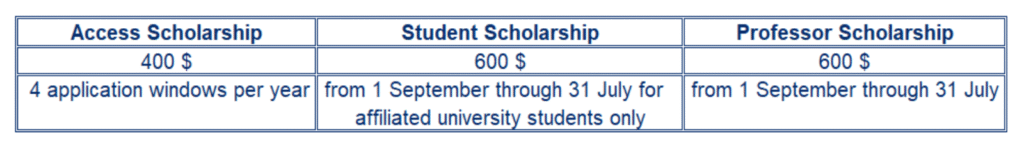

CFA Scholarships

Meet Our Talented Instructors